The price set on Greenhouse Gas (GHG) emissions is known as a carbon tax. It plays a central role in reducing GHG emissions and combating climate change. It is a financially flexible tool that automatically encourages consumers and producers to shift towards energy options that emit less carbon, whatever those options may be. Economists call this an efficient solution because those who create this cost will pay for them instead of shifting it to others.

As of July 2022 twenty seven countries have implemented a carbon tax and only one of them is located in Africa. Globally, as at the time of this writing, countries that have implemented the carbon tax are about 27 and, interestingly, there is an African country: South Africa (SA).

South Africa Carbon Tax

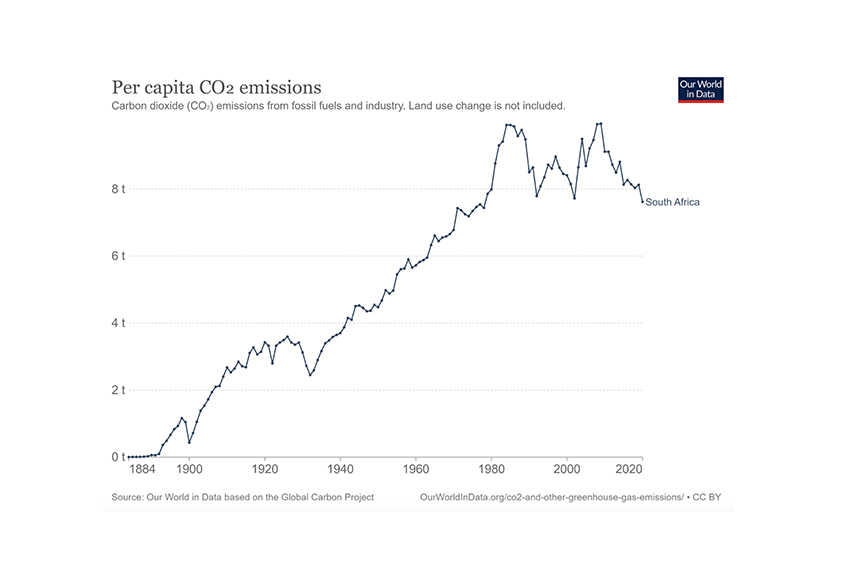

South Africa is the continent’s most energy-intensive economy and one of Africa’s worst polluters. In 2019, SA ranked 16th among the largest emitters of greenhouse gases (GHGs) on the global emission list. Its economy relies heavily on coal, fossil fuels to produce electricity. On average, a person emits about 7.6 tons of CO2 every year.

Upon ratifying the Paris Agreement on climate change in 2016, the government of South Africa committed to reducing emissions by 17 per cent by 2025 and 32 per cent by 2030. As part of implementing this ambition, the South African government passed a Carbon Tax Act in June 2019, requiring all sectors to pay the price for GHG emissions with the exemption of Waste & Agriculture Forestry and Other Land Use (AFOLU) sectors in the first phase.

The South African Tax Design

The South African carbon tax considers feasible and practical measures to ensure a smooth transition to a low carbon economy. These measures include tax-free allowances and a phased-in approach. These allowances enable emitters to transition their operations to cleaner technologies with a low tax burden. A key feature of the carbon tax act is the carbon offset allowance which allows companies to reduce their carbon tax liability by 5 to 10 per cent.

The carbon tax rate was imposed at R120 ($8.30) and specified to increase by the amount of consumer price inflation plus 2 per cent annually in the first phase (2019-2022). As of February 2022, South African Finance Minister Enoch Godongwana announced the new carbon tax rate set at R144 ($10) per ton of CO2e. He also stated that the first phase extends to 2025, and the carbon rate will increase annually to $20 per ton and $30 by 2030, while the allowances offered to emitters to lower the cost burden will “rapidly fall away”.

A number of transitional carbon tax allowances, which range from 60-95 per cent, are provided for specific industries depending on each company’s activities related to fuel combustion emissions, transportation activities, and process emissions. There is a provision for an industry-specific tax-free emission threshold. It is an incentive for mitigation and provides flexibility for companies to reduce emissions.

Carbon Offsets

Enabling carbon offsetting under the SA carbon tax is very instrumental to companies. It provides additional flexibility that allows companies access the least-cost mitigation options where carbon tax law is enacted. It also allows companies to reduce emissions outside of their operations when they do not have emission reduction options in-house.

A carbon offset is also good to incentivise mitigation in economic sectors, activities that are not directly subject to the carbon tax and benefit from other government incentives. Increased carbon offsets will reduce the carbon tax liability on the company.

Under the South Africa carbon tax act, only project activities outside the scope of activities subject to the carbon tax are allowed. Also, only South Africa based credits will be eligible for use within the carbon offset scheme. Carbon offset projects registered and or implemented before the introduction of the carbon tax will be accepted subject to certain conditions. The carbon offset regulation for SA was published in June 2016 and revised in 2018 but not finally published.

Though using carbon tax offsets is not mandatory, purchasing them helps companies to reduce carbon tax payable to SARS (tax office) by up to at least 15% a year. It also boosts corporate social investment and supports sustainable development goals (SDG) by channelling much-needed investment into tangible South Africa projects.

How Offsetting works

With emissions from projects within the company scope, a company is liable to a carbon tax. The company can develop emission reduction activities or projects to reduce the carbon tax burden.

This project or activity, however, cannot be used as an offset project, and credits cannot be issued. To be eligible to receive carbon credits, the project activity has to be a different activity that is not within the company’s scope of operations to obtain carbon credit for the company (which means it will be eligible for credits).

In phase one (1) of the carbon tax implementation, only South African projects are eligible in terms of credits. Still, there is the idea that South Africa National Carbon standards could be appropriate or applicable for local conditions and framework in future.

Projects activities under the South African Carbon Offset

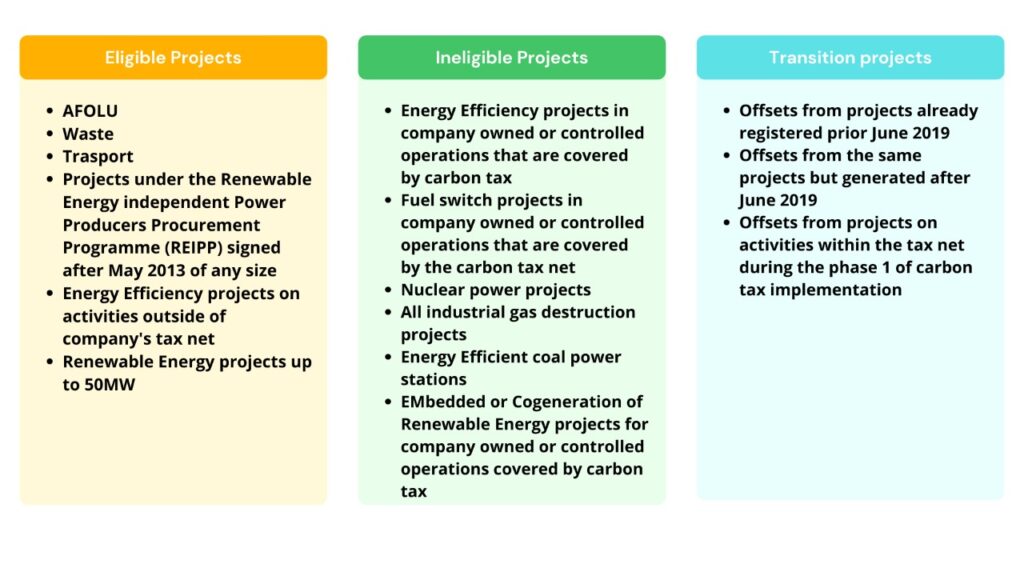

Offsets issued under one of the carbon standards after June 2019 have no restrictions. However, projects registered prior to June 2019 are eligible provided they are transferred from the international to the local registry within Phase 1 (June 2019- Dec 2022). Also, offsets issued after June 2019 from already registered projects are eligible provided they are transferred and used within one year after the end of the first phase by December 2022. Eligible projects are identified below.

The first phase of carbon taxing (2019-2022) permits projects developed under the Clean Development Mechanisms (CDM), Verified Carbon Standard (VCS) and Gold Standard (GS) for use by companies to reduce their carbon tax liability.

Under the South Africa carbon tax act, specific eligibility for carbon offset projects include:

- Only projects located in South Africa are eligible for use within the carbon offset scheme.

- Renewable energy (RE) projects: RE projects under the REI4P in bid window 1&2 are not eligible. RE projects under the REI4P in bid window 3&4 and less than 15MW are eligible, projects greater than 15MW in this bid window must cost greater than R1.09/kWh. Projects that are not under the REI4P must be less than 15MW and if greater than 15MW, it must cost greater than R1.09/kWh for it to be eligible.

- Non-renewable energy projects: Projects in this category are eligible if they are not carbon taxable. However, if the project activity is carbon taxable, the credits generated until 31st May 2019 are eligible only until December 2022.

Though using carbon tax offsets is not mandatory, purchasing them helps companies to reduce carbon tax payable to SARS (tax office) by up to at least 15% a year. It also boosts corporate social investment and supports sustainable development goals (SDG) by channelling much-needed investment into tangible South Africa projects.

Carbon Offset Projects under the South African Carbon Tax

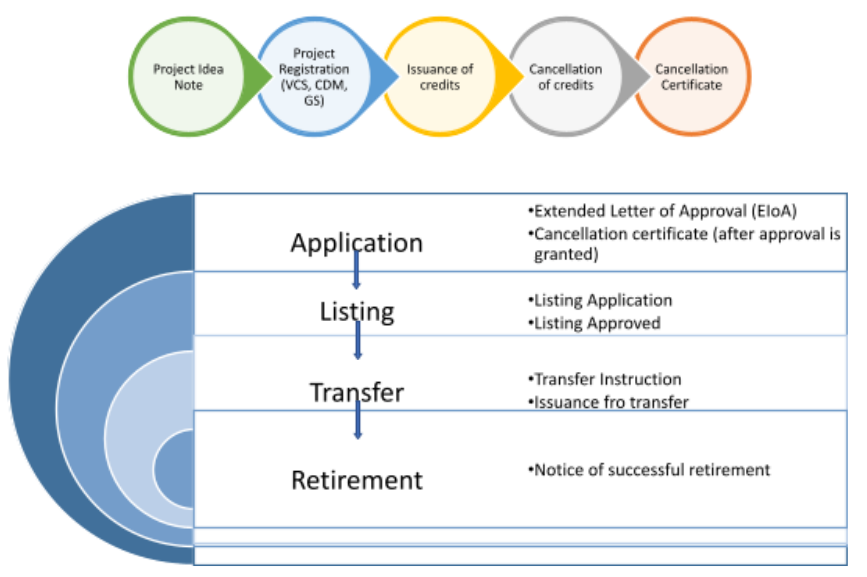

To transfer offset projects from the international registry, companies need to get a letter of approval on eligibility and obtain a cancellation certificate. This certificate will be submitted to the local registry Carbon Offset Administration System (COAS), after which the credits will be retired from the international registry. The company will receive approval before cancelling the corresponding volume in the international registry to avoid losing the credits. The company will then submit these documents to the tax office; when it is ready to use, the offset is deducted from the tax payable, and the offset will be retired in the corresponding volume.

TRADITIONAL REGISTRATION AND ISSUANCE PROCESS – CANCELATION/RETIREMENT OF CREDITS

Conclusion

Carbon Taxing is an effective strategy to reduce carbon pollution at a lower cost with fewer restrictions. However, with this stride by the South African government, industry experts warn that in a country where the official unemployment rate is about more than 27 per cent, carbon taxes are anti-growth, anti-jobs, and anti-investment. The problem is that cost increases, and there are uncertainties of how the tax will be applied because carbon budget and carbon offset regulations are yet to be published.

At ALLCOT Trading, our mission is to promote additional sustainable impact with every transaction. If you want to achieve this in a fair, transparent and win-win scenario, contact us and together we will make it happen.

For more information about the carbon tax system in South Africa contact Elizabeth Omogbai: eo@allcot.com