You probably have heard of the issue of corresponding adjustment before but, what is it really for? Let’s start from the basis that one carbon credit is equivalent to a tonne of CO₂ emissions reduced or removed from the atmosphere by an offsetting project. Any nation, company, or individual can offset their emissions by investing in these projects or buying the credits.

The key concern over the integrity of carbon credits is Double-counting or Double-claiming. This means that an emission reduction or removal is occurring once but is claimed twice. It occurs when a project’s host country claims the outcome towards its NDC, meanwhile, it is also claimed by another country, or an entity.

In that case, offsetters cannot be aware of the true rate at which the emission reductions and removals have been achieved, therefore, they fail to realize their climate targets even though they have spent a significant amount of money on them.

Corresponding adjustment

Corresponding Adjustment (CA) is stated in Article 6 of the Paris Agreement as a tool to avoid double-counting in carbon trading. Below are more details related to CA for the Internationally Transferred Mitigation Outcomes in both compliance market and the voluntary market.

Accounting for NDCs Internationally Transferred Mitigation Outcomes

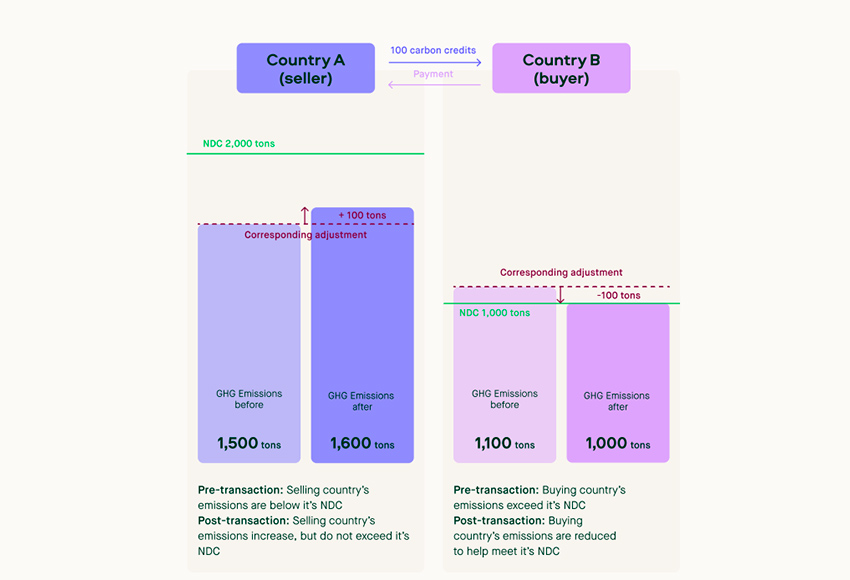

Corresponding Adjustment is a compulsory carbon accounting correction for country-to-country carbon transfer and trading mechanisms toward their NDCs.

When a CA is applied, transferred carbon is discounted from the selling country (i.e., the host country where the project is located), before it can be counted in the buying country.

When it turns to the operationalization of CA, several concerns have arisen, some of them are:

- What the metric for CA is

- How the CA can be assured

- The moment that the CA has to be done

- How CA would be performed, etc

There has been no concrete answers to these questions yet. However, there are some key aspects are under discussion, for example, the metric CA should be the one in which progress is reported towards implementation and achievement of a country’s NDC; when CA would depend on the timeline of: (1) Initial reporting: submitted at the time of first transfer or acquisition of ITMOs, to the Secretariat & the Article 6 technical expert review; (2) Regular information: submitted every year to the Secretariat & the Article 6 technical expert review; (3) Biennial Transparency Report: submitted to Article 13 technical expert review.

Accounting for non-NDC Internationally Transferred Mitigation Outcomes

Since the Article 6.2 guidance refers to the carbon credit trading mechanism towards NDCs, the key question is whether the guidance can apply to the ones not used towards NDCs (e.g. CORSIA and voluntary markets), and if CA are mandatory in this case.

The answer is that the choice belongs to the host country, since providing CA for the voluntary market imposes a significant cost for the host country for the necessary infrastructure (institutional and technical capacities) to support this mechanism. Additionally, the amount of emission reduction or removal from the voluntary activity cannot be counted in the country’s NDC. Therefore, the country will need to achieve extra emission reductions or removals.

International standards should also provide safeguards against double counting, including double issuance or double use.

For example, Gold Standard will require the project developer to provide a letter of assurance and authorization from the country where the project’s emission reductions or removals have occurred, which includes some key information such as:

- The project’s title and idea

- Acknowledge that the project may reduce or remove emissions in the host country

- Authorize the use of the emission reductions or removals, issued as offset credits to the project

- Declare that the host country will not use that amount of emission to achieve its NDC, etc., as well as the signature and contact details of the responsible one of the host country.

Gold Standard also plans to publish an annual report to share information on credits disaggregated by the host country and vintage year that are issued and for which countries have authorized the use of the associated emission reductions or removals by other countries or entities, qualified by the program for use under CORSIA and for other offsetting purposes, or canceled to meet offsetting requirements under CORSIA and other offsetting purposes.

Did you know?

Ecoregistry (CERCARBONO’s Registry) is the first one to add a “Corresponding Adjustment” field to their system.

A retirement page, which shows how many credits of a specific vintage were issued, sold, and canceled, of a lot of certifying bodies and projects, shows a certain level of traceability to avoid double counting.

At ALLCOT Trading, our mission is to promote additional sustainable impact with every transaction. If you want to achieve this in a fair, transparent and win-win scenario, contact us and together we will make it happen.