Carbon credits and ITMOs (Internationally Transferred Mitigation Outcomes) are used in the context of climate change mitigation and the reduction of greenhouse gas emissions. To understand what their similarities and differences are, it is important to know what they are, how they work and under what settings they can be used.

Carbon credits:

Carbon credits are units that represent one ton of greenhouse gases (GHG) reduced or removed from the atmosphere. These credits are generated through the implementation and operation of carbon projects, which are divided into two main types: Technology Based Solutions (TbS) and Nature Based Solutions (NbS). TbS projects include renewable energy projects, waste projects and eco-efficient stoves, among others, and NbS projects include reforestation projects, afforestation, mangroves, sustainable agriculture, among others.

Carbon credits are generated through validation and verification processes by external entities, which prove that there has been a reduction or removal of GHGs due to the operation of the aforementioned projects. This is carried out under different international programs such as the Clean Development Mechanism (CDM), Verfied Carbon Standard (VCS), Gold Standard (GS), among others.

Carbon credits can be used in the voluntary market and in the regulated market. In the voluntary market, they are usually traded to private or public companies wishing to offset the carbon footprint generated by their activities. In the regulated market, they can be used to totally or partially offset the obligations that some companies have under mechanisms such as emissions trading systems (ETS) and carbon taxes in different countries.

ITMOs (Internationally Transferred Mitigation Outcomes):

ITMOs are a type of unit that, like carbon credits, represent a ton of GHG reduced or removed from the atmosphere, which must be verified by an external entity.

This figure was born out of Article 6.2 of the Paris Agreement. Specifically, this article provides a framework for countries to transfer their greenhouse gas (GHG) mitigation performance to other countries in order to meet their emission reduction commitments. These commitments are set out in the Nationally Determined Contributions (NDCs) of each member country of the Paris Agreement.

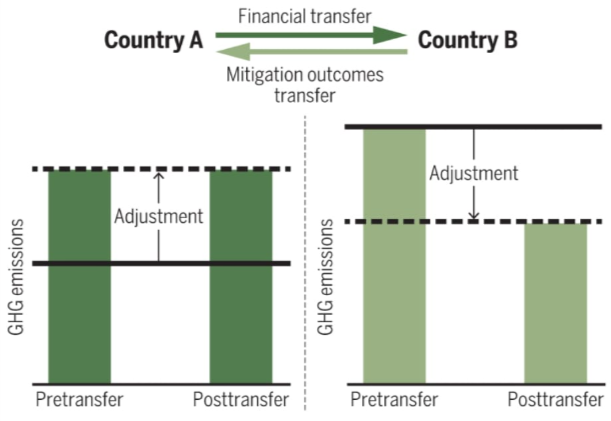

In essence, a country that fails to meet its emission reduction targets (according to its NDC) can purchase ITMOs from another country that has achieved emission reductions beyond its national targets, as set out in its NDC.

This mechanism allows the selling country (that has achieved emission reductions beyond its domestic targets) to profit from the sale of these ITMOs and the buying countries that have not achieved their targets to meet their emission reduction commitments.

(Mehling, M., et al ,2018)

What is the difference?

The main difference between carbon credits and ITMOs is that carbon credits are units generated by different types of projects that can be purchased by private or governmental entities to offset their emissions, while ITMOs are part of a mechanism created under the Paris Agreement that allows countries to trade verified emission reductions with each other, enabling some parties to meet their national emission reduction commitments (NDCs) and others to obtain economic benefits for achieving emission reductions beyond their national targets. ITMOs are used internationally and are a form of cooperation between countries to achieve global climate goals.

References:

Kerschner, S., et al (2023) Emerging Fundamentals in Climate Mitigation Through ITMO Transactions Under Paris Agreement Article 6.2, https://www.whitecase.com/insight-alert/emerging-fundamentals-climate-mitigation-through-itmo-transactions-under-paris#:~:text=These%20transferred%20climate%20change%20mitigation,transactions%20are%20starting%20to%20emerge.

Mehling, M., et al (2018) Linking climate policies to advance global mitigation, https://www.science.org/doi/10.1126/science.aar5988

An article by Mario de Oliveira and Dana Parra