Introduction to carbon markets

Climate change has become one of the most critical challenges facing our society today. To address this problem, different approaches have arisen, amongst them, carbon markets. Greenhouse gas (GHG) transactions have been recorded since the 1990s, but it was not until 2005, with the entry into force of the Kyoto Protocol and the launch of national GHG emissions trading systems, that these markets were boosted.

Carbon markets seek to reduce GHG emissions and promote the transition to a more sustainable economy. Today we can talk about two markets: regulated and voluntary. In this article we will explore how these markets work and what differentiates them.

Regulated market

The regulated carbon market is characterized by the imposition of legal limits and restrictions in order to regulate GHG emissions emitted by companies and industries in specific sectors. These limitations may include an emissions cap or the application of a carbon tax. The main objective of the regulated market is to achieve significant and quantifiable reductions in carbon emissions through legally enforceable measures.

There are bodies and agreements that provide guidance and standards for regulated markets, some of the most relevant of these being the following:

From an international standpoint, we have the markets under the Kyoto Protocol that allowed developed countries to credit reductions from projects conducted in developing countries. On the other hand, we have the Paris Agreement, which generally proposes two cooperative mechanisms that create two new carbon markets, through its Article 6.

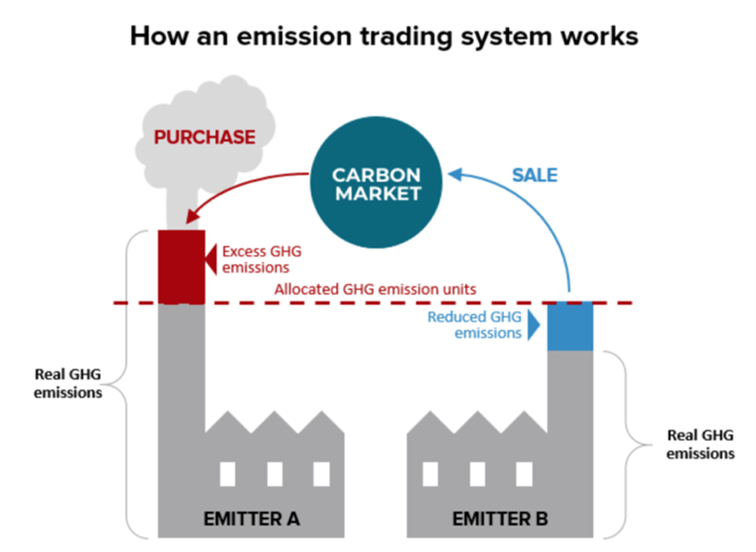

Then, at the national and regional level, we have, for example, the Emissions Trading System (ETS), a market-based instrument that allows governments to reduce Greenhouse Gas (GHG) emissions. In this case, each government sets a limit on the GHG emissions that one or more economic sectors can generate. Regulated companies must hold allowances to support their GHG emissions. Under this market, if companies do not comply, they could be penalized with fines. The goal of the system is to contribute to the fulfillment of each country’s reduction target, established under the Paris Agreement.

Another mechanism within the regulated market is the carbon tax, whose approach is simpler, as it establishes a price by defining a fee on GHG emissions in the sectors it regulates.

It is important to note that specific oversight and controls may vary by country and the regulatory system in place. Each jurisdiction may have its own government agencies and governance structures in charge of market administration and control.

Voluntary market

The voluntary carbon market is a non-binding option in which companies and individuals can participate on a voluntary basis to offset their emissions by purchasing carbon credits. Unlike the regulated market, there are no legal restrictions or penalties associated with it. Instead, participating organizations do so for different reasons such as: fulfilling corporate social responsibility commitments and/or enhancing their reputation and demonstrating their commitment to sustainability.

In the case of the voluntary carbon market, there is no centralized body or international authority that controls it in a uniform manner. However, there are some recognized organizations and standards that provide guidance and certifications in the voluntary carbon market. These organizations play an important role in the development and promotion of carbon offset projects and in the verification of the offsets made. Some of the more noteworthy bodies/standards are:

Gold Standard, Verified Carbon Standard (VCS), Climate Action Reserve, CERCARBONO

These organizations and standards help ensure integrity and transparency in the voluntary carbon market by establishing criteria and verification procedures.

Conclusion of carbon markets and its differences

The difference between the regulated and voluntary carbon market lies in its enforceability. The regulated market imposes legal limits and restrictions on GHG emissions, while the voluntary market is a non-binding option based on corporate responsibility. Both approaches seek to reduce carbon emissions and address climate change. The regulated market drives large-scale changes through government regulations, while the voluntary market allows organizations to take additional action. It is true that each market has requirements that must be met, but this does not make them mutually exclusive; they can coexist, interact, and complement each other for effective action on climate change and building a sustainable future.

At ALLCOT Trading we are active in these Markets and always looking to promote positive change. If you want to achieve this in a fair, transparent and win-win scenario, contact us and together we will make it happen.